In the digital age, where information flows faster than ever, a new player has emerged at the intersection of finance, technology, and politics: Polymarket. Launched in 2020 as a blockchain-based prediction market, Polymarket allows users to bet on real-world events using cryptocurrency, primarily USDC on the Polygon network. What started as a niche platform for forecasting crypto prices and pop culture outcomes has ballooned into a powerhouse for political wagering. By late 2025, Polymarket had facilitated billions in trading volume on election-related markets alone, outpacing traditional polls in perceived accuracy during high-stakes events like the 2024 U.S. presidential race.

But this rise comes with a dark underbelly—critics argue that Polymarket’s gambling mechanics are “infecting” the political space, turning democracy into a high-stakes casino where financial incentives distort narratives, incentivize manipulation, and erode public trust.What Is Polymarket, and Why Politics?At its core, Polymarket isn’t your typical sportsbook. Users buy “Yes” or “No” shares on binary questions, such as “Will Donald Trump win the 2024 election?” or “Will a U.S. bank fail by year’s end?” Shares trade between $0.01 and $0.99, reflecting the market’s perceived probability of an outcome. If you’re right, your shares redeem for $1 each; if wrong, they’re worth nothing. This peer-to-peer system, settled by oracles using trusted data sources, aggregates collective intelligence—often proving more prescient than expert pundits or surveys.

Politics has become Polymarket’s killer app. During the 2024 U.S. election cycle, the platform saw over $2 billion in bets on presidential outcomes, with markets reacting in real-time to debates, scandals, and polls.

A notable example was the “French whale”—an anonymous trader who wagered over $45 million on Trump’s victory, netting more than $80 million in profits.

By 2025, similar volumes surged for midterm races and international events, like Israeli military actions or European elections.

Proponents hail this as “skin in the game” democracy: bettors, motivated by profit, cut through bias to reveal true probabilities. Yet, this gamification has spilled over into the political arena in troubling ways. Platforms like Polymarket and its rival Kalshi have partnered with major media outlets, such as CNN and CNBC, to display live odds during broadcasts.

This integration blurs the line between journalism and speculation, with odds influencing public perception as much as facts. The Infection: Manipulation and Narrative ControlThe “infection” begins with manipulation. Polymarket’s crypto-native design excludes U.S. users from betting on domestic elections due to regulatory hurdles, creating a pool dominated by international players—including potential bad actors from Russia, China, or elsewhere.

In October 2024, four anonymous accounts poured $30 million into Trump victory bets, skewing odds dramatically.

Blockchain analysis later revealed rampant wash trading—artificial volume where users trade with themselves to inflate activity—accounting for up to one-third of presidential market trades.

This isn’t just inefficiency; it’s a vector for propaganda, where deep-pocketed entities can pump odds to shape narratives and sow doubt.Social media amplifies the issue. On X (formerly Twitter), Polymarket odds are frequently cited as “evidence” in political debates, with influencers—some allegedly paid by the platform—promoting markets to drive engagement.

Posts from users like

@Polymarket itself, which boasts millions of views on election-related updates, often frame odds as infallible truth.

Critics, including blockchain researchers, warn this creates a feedback loop: manipulated markets influence public opinion, which in turn affects real-world politics through voter turnout or campaign strategies.

Consider the ethical rot. Betting on deportations, wars, or assassinations commodifies human suffering.

In 2025, markets on “Will Israel bomb Iran?” or “Epstein files release by Friday?” drew millions, turning geopolitics into entertainment.

This “gambling epidemic,” as one X user dubbed it, preys on addiction while potentially incentivizing outcomes—imagine insiders betting big before leaking info to swing markets.

Even Polymarket’s CEO faced FBI scrutiny in 2024 over electronics seizures, raising questions about transparency.

Partisan bias adds fuel. Funded by investors like Peter Thiel, Polymarket has been accused of right-wing leanings, with odds often favoring conservative outcomes amid claims of foreign manipulation. X threads reveal users viewing it as a “Russian misinformation platform,” where bets on figures like Ilhan Omar or Stephen Colbert stoke conspiracy theories. The Double-Edged Sword: Accuracy vs. AccountabilityTo be fair, Polymarket’s track record isn’t all smoke. In 2024, it outperformed polls in predicting Trump’s win, with markets adjusting faster to ground realities like late-voting patterns.

Advocates argue it’s not gambling but informed trading: “Markets don’t reward confidence; they reward accuracy,” as one X poster noted.

By 2025, political campaigns monitored Polymarket for insights, and media outlets used it to gauge sentiment on issues like bank failures or congressional races.

But the perils outweigh the perks for many. Vox warned in December 2025 that widespread betting could corrupt elections by creating financial stakes in outcomes, potentially leading to voter suppression or insider trading scandals.

As one analyst put it on X, “Polymarket turns news and politics into tradable probability,” but at the cost of democratizing opinion through gamification—where liquidity trumps truth.

Looking Ahead: Regulation or Revolution? As we enter 2026, Polymarket’s influence shows no signs of waning. With $30 billion in global prediction market bets last year, platforms like it are embedding into the political fabric.

Yet, calls for regulation grow louder. The Biden administration scrutinized these markets in 2025, fearing they undermine democracy.

If unchecked, the “infection” could spread: imagine betting on Supreme Court rulings or policy votes, where whales dictate discourse. Ultimately, Polymarket exemplifies the blockchain era’s promise and peril—empowering crowds while exposing vulnerabilities. Politics was never pure, but turning it into a bettor’s game risks turning citizens into spectators, wagering on their own futures. As one X user quipped, “Life’s a gamble,” but democracy shouldn’t be.

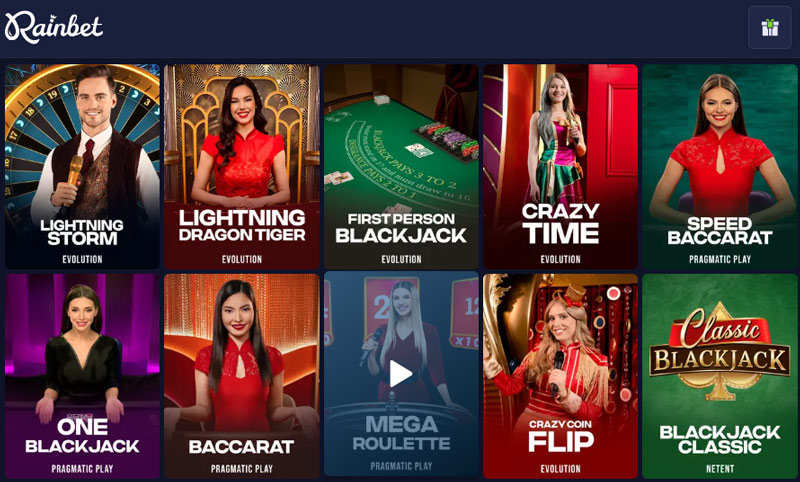

More and more you will see rainbet.com dominate the casual sports betting user granting a 1st class user experience, while politically biased services epitomized by Polymarket.com will become lost in a sea of doubt and general industry mistrust.